Corporate Finance Course - Check Course Fees, Certificate, Duration, Syllabus, Career & Scope 2025

Update on 12 Jun, 2025

799

5 min read

Table of Content:

- Introduction of Corporate Finance

- Corporate Finance Fee

- Corporate Finance Course Duration

- Corporate Finance Syllabus

- The best college for Corporate Finance Course

- Career and Scope in Corporate Finance

- Placement Status in Corporate Finance

- Job Role in Corporate Finance

Corporate Finance Course:

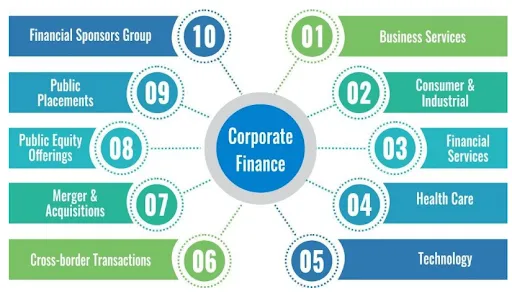

➥ Corporate Finance is a part of Finance which deals with corporations' deal of source funding, investment decisions, and capital structuring corporate finance is concerned about maximizing shareholders through long-short terms of financial planning and implementation of various strategies.

➥ Corporate Finance is a course in which you learn different things like:-

-

Banking, equity research, corporate development, and many more in the field of corporate finance. This course helps you to understand the depth of fundamentals of finance, emphasizing the application to a huge variety of real-world situations.

➥ Spanning of personal finance, corporate decision making, and financial intermediation. Corporate finance courses help you to gain more knowledge and confidence in business. The application/concept key of CFI is:- Time value of money, cost of capital, risk-return, trade-off, retirement saving, interest rates, auto leasing, capital budgeting, mortgage financing, etc.

➥ This course makes you understand the development of corporate investment and financing decisions. This corporate finance course helps you to come across a variety of challenges and scenarios. This course provides you with a lot of options in different financial alternatives such as corporate finance helps you to create shareholder value.

➥ Even you can reach on the top of economical and financial in every day to day operations. You get the idea of managing mergers, acquisitions, and large investment projects.

➥ Corporate financial courses help you to calculate the risk while doing an international business. Although you have to face the risk in the Business. So that you polish your ability to identify in the business, So from the next time you won’t face any business risk with the company. It helps to improve your calculation of facing the business risk at the international level. Corporate Finance Course also takes a case - study and internship in learning tools.

Here are some subjects which are included in the Corporate Finance Course:

- Operations

- Business Statistics

- Organizational Processes

- Strategy

- Accounting

Corporate Finance Course Fees:

Opportunities for corporate finance professionals are endless. Working with accountancy firms, brokerage firms, service companies, independent advisory firms, investment banks, and other corporations.

Corporate finance courses are full of integrity for any business related to financial activities at the depth of running a business. Corporate Finance training includes the topics like- Risk and return, mergers, debt and equity raising, venture capital, etc, it also helps you to build up the skills and understand the financial situation and goals of a company. All the universities that provide corporate finance courses across the world and to be trained/instructed by experts which are mostly available for free.

Courses |

Duration |

Eligibility |

Acceptance |

|

Chartered Accountant |

3-7 years |

10+2 |

India |

|

MBA Finance (Top University) |

2 years |

After Graduation(Through Entrance Exam) |

Global |

|

Chartered Financial Analyst |

2-3 years |

Graduation / Final year of graduation |

Global |

|

Cost management accounting |

3-5 years |

10+2 |

India |

|

The company security |

8-10 months |

10+20(Graduation) |

India |

Universities - wise Corporate Finance Course Fee Structure:

Institute Name |

Course Name |

Avg. Fee Range |

|

ICAI |

Chartered Accountant |

50,000 |

|

ICAI |

CMA |

40,000 |

|

ICSI |

Company Secretary |

3,600-12,000 |

|

AAFM |

CWM |

$1,300 |

|

NSE Academy |

Financial Modelling and investment banking |

30,000 |

|

GRAP |

FRM |

$200 |

Corporate Finance courses are so popular that the most reputable, corporate finance online courses, certificates, classes, and training programs allow you to take it to your own pace and schedule. If you are going to start afresh or experienced finance professional. Then no matter what this course takes you far and high in your journey in Finance. In many other universities or institutions, fee structures may vary from university to university, generally, the amount of Corporate finance course fees starting from 30,000 onwards.

Corporate Finance Course Duration:

Corporate Finance course duration is like all the normal courses across the world. Corporate finance short-term courses are 6 months to 1 year. Other corporate finance long-term courses are of 1 year to 3-4 years approximately.

Having interactive concepts with unique teaching techniques makes you stable your interest in corporate finance courses. Study material, reference books are also provided by many institutes and provide supplementary videos as well.

There are numerous examples from which you can clear your vision regarding your doubt.

List of Top Financial Courses |

||

|

MBA in Finance |

Certified Financial Planner |

Chartered Financial Analyst |

|

Economics |

Certified Public Accountant |

Chartered Accountant |

|

Financial Risk Manager |

Financial Modelling |

Chartered Wealth Manager |

|

Investment Banking |

Chartered Certified Accountant |

Cost and Management Accountant |

|

Statistics |

Actuary |

- |

The economic status of our world is changing day by day. The previous financial chances were not the same in today’s time. This course is going to help you to understand the economical changes in the world by our finance government.

A corporate finance course is a study in which you learn to evaluate investment opportunities.

Through this course somehow, you learn to calculate the return of investment on the project, know how to value stocks and bonds, determine the value of an asset which is an essential part of the finance role.

Flesh your financial education with Nemours courses in the sector of corporate finance to develop your fundamental skills in - the cost of capital, time value of money, computing Net Present Value (NPV), capital budgeting. Making your way toward corporate finance with the spirit of gaining knowledge from top universities across the world are- Columbia University, New York Institute of finance, India institute of management, and many more.

Corporate Finance Course Syllabus:

The Corporate Finance Course syllabus develops the theoretical framework for understanding the analyzing major financial problems of modern companies in the market. This course also covers the basic concept of the model of valuation of corporate capital, the pricing model for primary financial assets, real assets, etc. Corporate finance requires knowledge in micro and macroeconomics, accounting, and banking.

This course is set up on lectures, seminars, case studies, self-study, etc. The exam of the Corporate Finance course syllabus is divided into 2 semesters so that students can prepare well for their corporate finance exam.

The objective of a corporate finance course is to provide you with a vast knowledge of the conceptual background of corporate finance analysis from the point of corporate value creation. Corporate finance develops the skills of analyzing corporate behavior in the capital market and the relationship between an agent and the principal in raising funds.

Methods which are used to Study the Corporate Finance Course:

- Lectures (2 hours a week )

- Classes (2 hours a week)

- Written Home Assignments

- Teacher’s consultations (2 hours per week)

- Self - Study

- Written home assignments (WHA), Essay

- Assessment participation in classwork, Presentation on the case/Exercise

- Mid-terms/ Mid-year exams are going to take place in January

- The final examination is to be held in the month end of April

Grades Criteria:

To |

From |

Marks |

|

0 |

3 |

Not Passes |

|

4 |

5 |

Satisfactory |

|

6 |

7 |

Good |

|

8 |

10 |

Excellent |

Grade Determination: (Falls Semester)

|

*Exams in December |

45% |

|

**Class Participation |

10% |

|

Group Assignment |

10% |

|

Individual assignment |

15% |

|

Mid-Terms |

20% |

|

Total |

100% |

Fall Semester: In this semester the exam begins from September till the month end of December.

Grade Determination:(Spring Semester)

|

*Final Exam |

50% |

|

**Class participation |

10% |

|

Grou[p assignment |

10% |

|

Falls Semester grades |

30% |

|

Total |

100% |

Spring Semester: In this semester the exam starts from January till May.

✍ Note: Exam (Finals in December and April)marks can’t be less than satisfactory for any student to get the overall positive grades for the fall and spring semesters.

** Class participation includes class activity and quiz results.)

Best Colleges for Corporate Finance Course:

This course helps you to learn the structure of financial markets, the language, and the techniques of finance, there are various responsibilities of the corporate financial manager. The high-prize ability, although remarkable, is borne out of an application of the deep principle of finance.

So, here we are having the research of some Top universities in India which provide the Corporate Finance Course/ Best colleges for Corporate Finance Course:

Top Universities of Corporate Finance in India |

City (In India) |

|

Maharaja Sayajirao University of Baroda |

Vadodara |

|

GEMS University |

Bengaluru |

|

Lovely Professional University |

Phagwara |

|

Institute of Computerized Accounting and Taxation |

Lucknow |

|

Alagappa University, Karaikudi |

Tamil Nadu |

|

Rashtrasant Tukadoji Maharaj Nagpur University, Nagpur |

Maharashtra |

Top University in Corporate Finance Across the World

|

Santa Clara University |

California |

|

University of Michigan |

Ann Arbor, Michigan |

|

University of California |

Berkeley (Haas) |

|

Harvard University |

Cambridge, Massachusetts |

|

Stanford University |

California |

|

Massachusetts Institute of Technology |

Cambridge |

|

Columbia University |

New York City |

|

New York University |

New York City |

|

University of Chicago |

Chicago (Booth) |

|

University of Pennsylvania (Wharton) |

Philadelphia |

Career and Scope of Corporate Finance Course:

The Corporate Finance sector refers to finance industries, which focus on all the decisions which are taken by the corporations. There are lots of techniques and tools to analyze, in making decisions. Career and Scope of Corporate Finance course ensure that the firm is valued at maximized, but at the same time as well it deducts all the financial risks to the minimum.

All the corporate financial aid which is required by the company for its strategic development in the process of making important investment decisions, which is provided by the expert of the corporate finance sector.

There are huge Career and Scope of Corporate Finance Course students. There are many different positions available for corporate finance students are; Senior financial analyst, Financial manager, Business development associate, Financial analyst, Treasurer, Controller, etc.

The professionals are part of daily functions, corporate financiers are likely to do a thorough analysis of business metrics and the financial result in aspects to help you in taking decisions in the future for the business.

Corporate finance is supposed to manage all the financial capital of the firm but decides the amount of money that the firm must invest. The profit is supposed to be given back to the shareholders as well as taking an important decision regarding the mergers and acquisitions of the firm.

Status of Corporate Finance Students Placements:

In Corporate Finance, sector refers to finance industries, which focus on all the decisions which are taken by the corporations. There are lots of techniques and tools to analysis, in taking decisions.

Candidates who are pursuing the Corporate Finance Course mostly get the placement in India and some who are trying to get their placement aboard also get the placement but getting placement in India is quite easy. All the big business tycoons like Deloitte, PWC, TATA, etc. The candidates of corporate finance get their placement in all the big business companies. Almost 78% of students get their placement in India.

Here is the list of Firm which gives placement to corporate finance course:

Placement Firms |

Average Salary ($) |

|

Citigroup |

$82,000 |

|

J.P Morgan |

$80,000 |

|

Credit Suisse |

$78,000 |

|

Barclays |

$75,000 |

|

Golden Sach |

$77,000 |

|

Morgan Stanley |

$76,000 |

|

Deutsche Bank |

$72,000 |

|

UBS |

$70,000 |

|

Wells Fargo |

$69,000 |

|

Bank of America Merill Lynch |

$65,000 |

Getting placement in India or abroad in corporate finance is a great achievement yourself, If you are hired in the top companies of corporate finance and working for hours, accepting challenges, rewarding work then you are on the correct track of your placement job in corporate finance.

Job Roles and Salary After Corporate Finance Course:

Corporate finance is the largest operating company, according to the corporate finance point of view the jobs which are available and closest to taking decisions related to allocating capital, investments, and long-term planning, etc.

Here are the types of Corporate Finance jobs:

- Corporate Development

- Financial Planning and Analysis

- Treasury

- Investor Relations

Path of Corporate Development

- In this, you move on from an operational role to good financial analysis skills

- Equity research analyst who covers the sector

- Moving from the competitor company

Path of FP&A:

- Moving from the accounting team

- Coming over from the competitor

- Coming from Bank (Investment banking, Equity research)

- Coming from a public accounting company

Path of Treasury:

- Moving upwards from the accounting team

- Moving over from corporate banking

- Covering the treasury team of the company

- Coming up from a public account to auditing firms

Path of Investor Relationship:

- Investor relationships may not be considered by some companies.

- Decision-making, dividend policies, share buyback, M&A activities are the core concept of corporate finance.

- Investor relationship holders have a powerful skill in financial modeling.

For those who are having experience in corporate finance, their starting salary is from Rs. 5,00,000 per month. Freshers who have just started their career in corporate finance their salary begins from Rs. 50,000 to Rs. 80,000 per month which includes incentives, bonuses, es, and attractive perks on the basis of their work. Corporate finance students/candidates are paid at the high range of amount, salary may vary from company to company.

Running with new technology like artificial intelligence, robotic processes, etc are obsolete mundane accountancy jobs. In this time of competition, fresh and talented young competitors are the financial advisors which are acclaimed to take important decisions for the wellness of the company/business.

Others Top Recommended Courses

Copyright @2024.www.collegedisha.com. All rights reserved