Update on 2024-04-15

Actuary Salary in India in 2025 – Skill and Experience Required

Details of Actuary Course 2025

To end up an actuary, you will want, at minimum, a bachelor's degree. The maximum direct route is to the principal in actuarial technological knowledge, a course of observation that includes math, statistics, and industry-related subjects.

However, other quantitative majors can produce properly-qualified applicants as well. Those majors commonly include computer technology, economics, arithmetic, physics, and information, amongst others.

Any principal that includes extensive coursework in mathematics, data, enterprise, control, accounting, economics, finance, and laptop programming has to be sufficient education for an actuarial profession.

But, schooling that also consists of the humanities, specifically English, would be especially beneficial. Actuaries should additionally know about topics inclusive of law and authorities and need to be capable of speaking effectively in writing and speech.

Top Five Skills of an Actuary 2025

Actuaries need a wide range of abilities to achieve success:

1. Analytical Problem-Solving Abilities

Actuaries want to be analytical trouble solvers as their responsibilities consist of analyzing complicated statistics and identifying styles and developments to determine which elements are accountable for precise results. After comparing and weighing the importance of these elements, actuaries search for approaches to decrease the probability of undesirable consequences or the cost of the realization of an undesirable outcome.

2. Math and Numeracy Abilities

Actuaries deal with numbers, so being able to do primary arithmetic quickly and efficaciously is a definite requirement. But, the math associated with actuarial technological knowledge can be extra complicated. Understanding calculus, facts, and opportunity are also essential since actuaries quantify hazards and decide the probable probability of positive events.

3. Computer Abilities

Computer systems and a variety of statistical modeling software programs are the gear of the actuary trade. Actuaries often use models and tables to evaluate big quantities of statistics. No longer simplest are fundamental computer competencies and an understanding of Microsoft office honestly crucial, however, being able to software in a statistical programming language is likewise a need.

4. Information on Commercial Enterprise and Finance

Agencies, economic establishments, and coverage groups regularly employ actuaries. As such, they're accountable for evaluating insurance or pension plans, advising companies on the way to limit publicity to economic danger, and supplying banks with expert critiques on maximizing returns for a selection of investment merchandise. This calls for a sound knowledge of enterprise and economic ideas.

5. Communique and Interpersonal Capabilities

Actuaries often collaborate with diverse personnel, including programmers, accountants, and senior control, which makes it imperative that they could communicate and work effectively with others.

Strong oral communication skills permit actuaries to explain complicated technical and statistical information to numerous target markets, at the same time as stable writing abilities ensure that findings and answers are effortlessly understood in memos and written reviews.

Actuaries additionally frequently lead groups on a spread of tasks and thus need to be able to take care of an assortment of personalities.

What's the Actuary Salary in India in 2025?

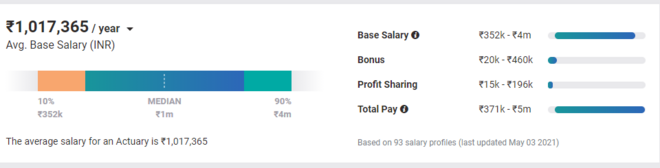

On average, the Actuary Salary in India in 2025 is to be around 10-11 Lakhs. As a fresher, you might have revenue of INR 3.5 Lakhs per annum, however, as you keep gaining enjoyment and abilities, the income of an actuary can rise to 50 lakhs per annum.

It is one of the most fulfilling and worthwhile careers for people who are appropriate with Maths and records. You get a bonus that levels from Rs. 20,000/- to Rs. 4.6 Lakhs per annum.

Related Articles

Trending News

Copyright @2024.www.collegedisha.com. All rights reserved